Why do you need to have access to your credit report? You may be asking that question. In fact, you are not the only one asking that question. More than ever before in history, people are getting into financial trouble and they need to have their credit reports and scores to keep them out of serious financial trouble later on. It is important for you to know what your score is so you can check it often and make sure no errors are being made on your credit reports.

Why would I need to have access to my credit report? There are many reasons why someone might need to have access to their credit report. For example, if you are applying for a new job, a new apartment, or even a new line of credit, you will need to have your credit reports and scores to qualify for the loan or line of credit you are applying for. If you have been making payments on an auto loan or secured credit card, your credit report will show those payments as being paid on time. This means you can qualify for the new auto loan or secured line of credit without as much difficulty as if you did not have your credit report.

What is the purpose of the credit report? The purpose of the credit report is to provide financial information to businesses, lenders, and other persons who might need your credit score or information in order to qualify for credit. For example, when you apply for a new job, the company needs to have some idea of your credit history. They will pull your credit report to determine if you are a good candidate for the job or not. If you have a low credit score, they may deny your application.

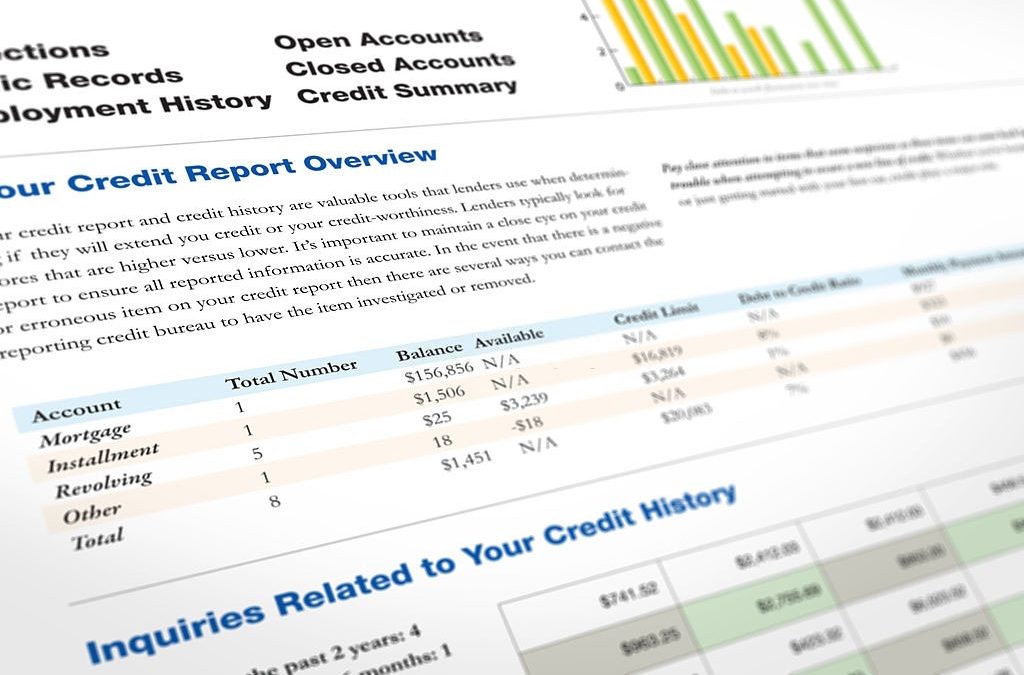

Why would I need access to my credit report if I am denied credit? You need to have access to your credit report in order to check for accuracy and to make sure that the information the report shows is correct. When a lender or employer checks your credit score, they are relying on the information contained in your credit report. If your credit report contains errors, the mistake could go unnoticed by the person who requested the information. It could go unnoticed for weeks or months and then finally come to light when you try to borrow money.

Why would you want access to your credit report if you already know my credit score? Your credit score is used to determine the interest rates on your loan or new line of credit. The higher your credit score, the lower the interest rate. That makes sense right? So why wouldn’t you want to check your credit report? There are a number of reasons.

If you don’t know your credit score, you may assume that you don’t need a report. However, you may be surprised to see an error in one of your reports. If this occurs, you’ll know right away. That means you can take action – call the reporting agency, make the error correction and notify them that you want your credit report without making the mistake. They may give you an explanation of why they reported the error.

Another reason is because you want to make sure that the other person receiving a loan or line of credit has the same credit profile as you do. When you check your credit report, other applicants will be matched based on their credit profiles. So if you have a poor credit report, you won’t qualify for the loan or line of credit. You may also want to check your credit report before you apply for a job so that you can find out if you’ll be granted the job. If you check your credit report before you apply, it’s possible that you’ll catch any errors and have them corrected before submitting the application.

Finally, it’s important for you to check whether the information you get from the credit bureau is accurate. The last thing you want to do is to obtain a loan or line of credit only to find out that your financial information is incorrect. Therefore, it’s important to ensure accuracy. By accessing a copy of your credit report annually, it’s easy to check for errors. This way, you avoid any issues with your loan applications or lines of credit.